Digital Credit Scoring with Artificial Intelligence

What is Credit Scoring?

Digital credit scoring is a technology that allows for instantaneous loan approvals and disbursements based on alternative data. Data collected from digital channels can be used to evaluate and rank potential borrower companies, determining their likelihood of repaying a loan.

For companies, digital credit scoring helps financial institutions and credit providers measure credit risk in an objective and reliable way. This allows credit providers to manage their risks and offers companies faster processes when applying for credit. Alternative data plays a significant role in digital credit scoring. This data can be gathered from a company's social media activity, payment habits, and other online transaction histories. Such data can be used in addition to traditional credit data, making credit scoring more accurate and comprehensive.

Deliverables for the project:

UX/UI Designer · Prototyping · Creating User Flow · Problem Solving · Design Thinking · Wireframing · Design System · Commitment to Agile principles

Problem

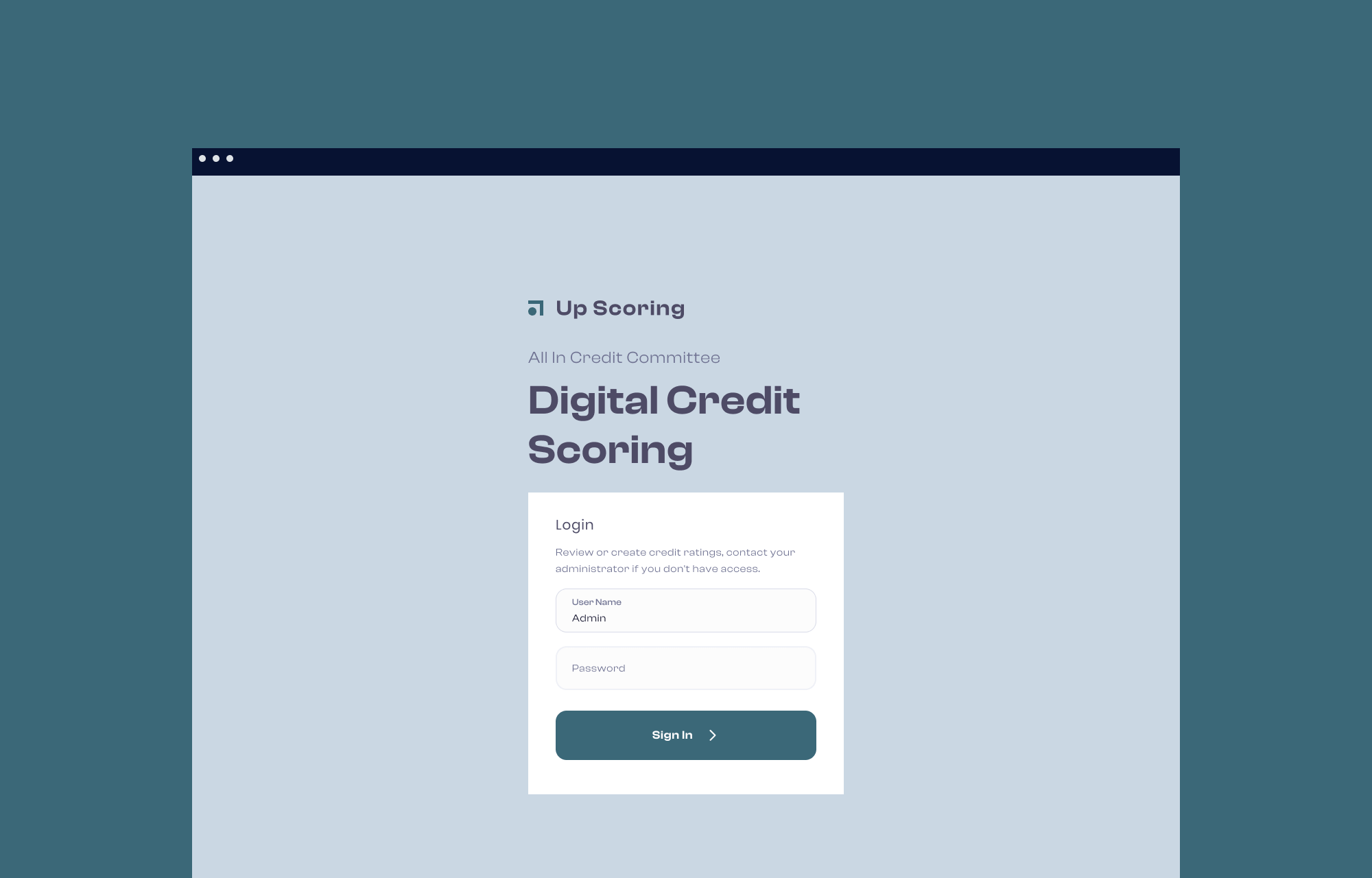

UpScoring is an internal platform that assesses the credit approval performance of institutions and organizations at certain rates. The platform presents the results of loans, such as approval or rejection, for applications submitted through digital channels. However, the primary issue was its outdated and complex interface, which negatively impacted the user experience. The platform featured an excel sheet-like structure with numerous data and tables displayed, leading to confusion and inefficiency.

Solutions

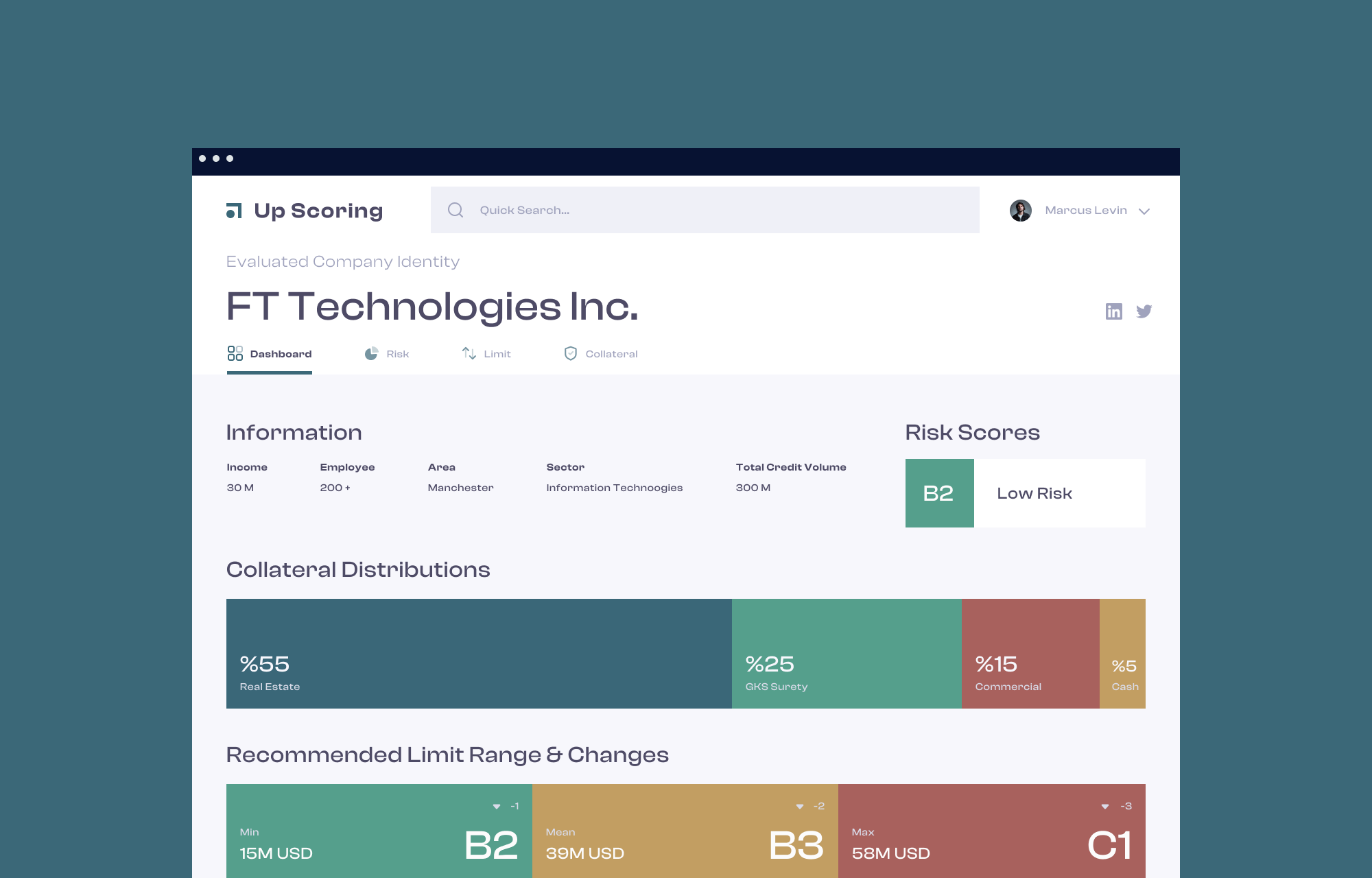

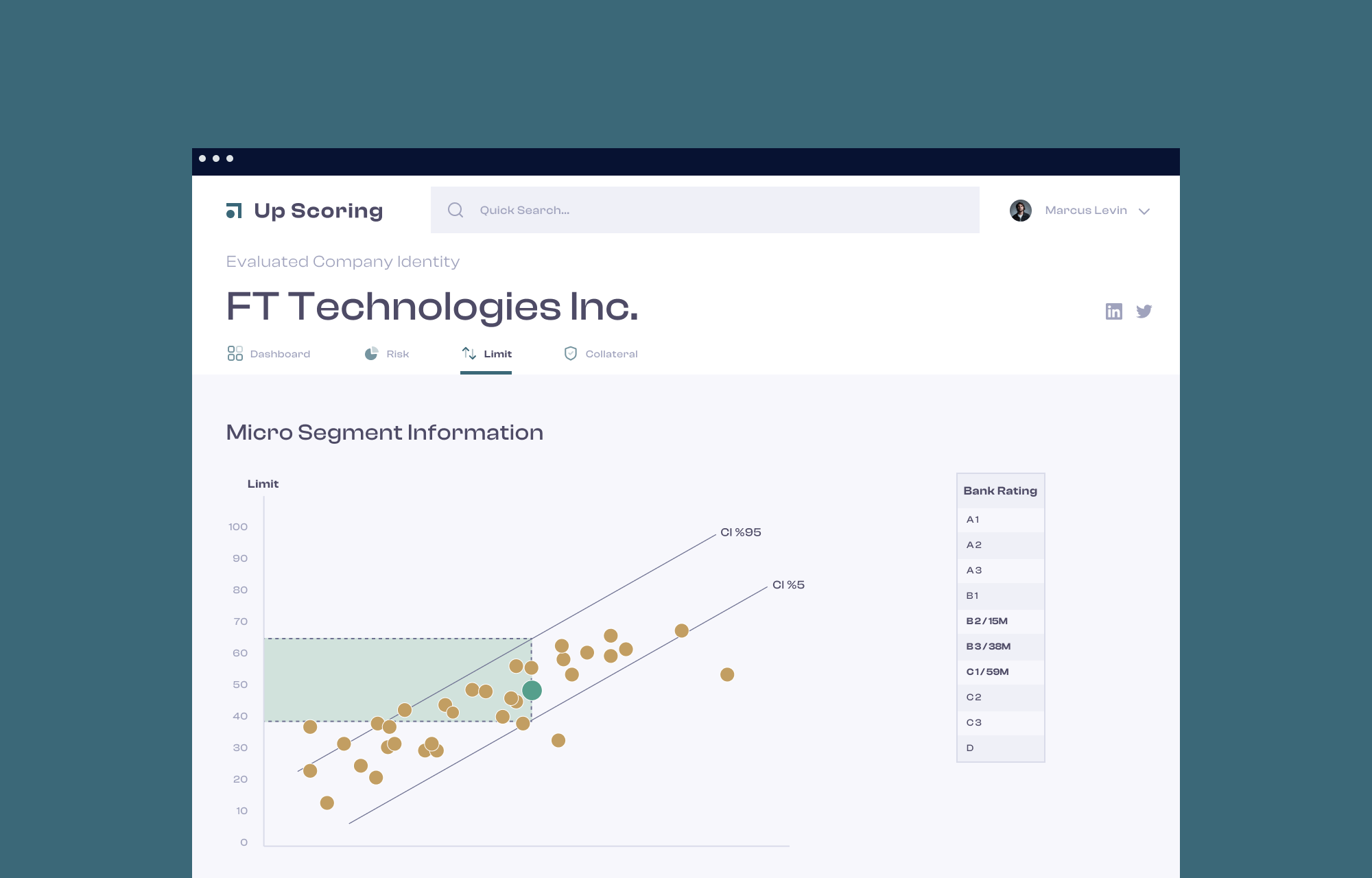

To address the problem, the primary goal was to make UpScoring more understandable and user-friendly. Significant contributions were made to the platform's transformation through new interface designs, prototypes, and flowcharts, ultimately leading to a modern, intuitive, and user-friendly system accessible via a web browser.

Collaboration with Users

As the platform's users were teams of analysts working internally, obtaining feedback was relatively easy. The objective was to simplify complex reports, data, tables, and visualizations so that users could make decisions more efficiently. By working closely with these users and incorporating their feedback, the platform's visualizations and overall design were improved, making the information simple and understandable.

Results and Benefits

The revamped UpScoring platform now offers a more streamlined and efficient user experience. The modern and intuitive interface allows users to quickly access and interpret relevant data, leading to better decision-making in credit approval processes. By addressing the initial problems and enhancing the platform's usability, both the institutions and their customers can benefit from a more effective and transparent credit assessment process.

The Result

Through diligent design efforts and a focus on user experience, a new and improved UX/UI was developed to make data management standards functional for financial services. By prioritizing simplicity, usefulness, and aesthetics in the design process, the revamped UpScoring platform has become more accessible and efficient for users.

This ongoing partnership demonstrates the value of adhering to core design principles, which ultimately leads to success in creating a powerful and user-friendly solution. By continuously collaborating with stakeholders and gathering user feedback, the platform remains adaptive and up-to-date with the evolving needs of the financial industry.

The enhanced UX/UI design not only streamlines the credit approval process but also fosters trust and satisfaction among users. As a result, both the financial institutions and their customers benefit from a more transparent and effective credit assessment experience. This success story highlights the importance of user-centric design in achieving positive outcomes and long-lasting partnerships in the world of financial services.

Let’s Talk

Let’s Talk